INTERVIEW: Oleo-X’s Mississippi, US renewable pretreatment facility expanding to meet growing demand

Crude Oil | Hydrogen | Refined Products | Distillers Corn Oil (dco) | Ethanol | 06/08/2023 18:36:57 ET

Author Janet Mcgurty, janet.mcgurty@spglobal.com

Oleo-X’s Pascagoula, Mississippi, renewable pretreatment plant has purposefully flown under the news radar, avoiding outside distractions preventing them from perfecting the process and mechanics to produce high quality renewable feedstock for the growing renewable diesel and sustainable aviation fuel market. Now, following their initial success producing high grade renewable feedstock they are comfortable in sharing their progress as they move forward and expand their operations. “As a founder you have a true vision. Especially working on this plan for a year and a half before we got started to how these pieces come together,” said Ivonne Gonzalez Ruggles, an investor with Inddevco and a founder of the project. Oleo-X is backed by investment group Inddevco which focuses on developing renewable energy and recycling projects in North America. Pretreatment units or plants are seen as a necessity for renewable conversions, with many projects added following their initial renewable project announcements. A PTU allows renewable fuel producers to expand their universe of feedstock materials away from soybean oil to more sophisticated and lower carbon intensity material, giving them the most credit value from the lower carbon intensity fuel produced. Ruggle’s vision – and a cornerstone of Inddevco’s philosophy – involves rethinking, reusing and repurposing existing infrastructure to adapt to current sustainable expectations. Which is how Oleo-X found a perfect candidate for its pretreatment plant in a shuttered chemical plant in Pascagoula, Mississippi.

Suitable facility

Seeking a chemical facility ready for tear down, Oleo-X chose Chemour’s First Chemical plant in Pascagoula to set up operations. The plant, shuttered at the end of 2020, had “very good metallurgy,” said Ruggles, which is why the project cost was well below that of building a new facility. While not divulging project economics, Ruggles said “it was much cheaper than everyone else because we really believe in reuse and repurpose of equipment.” It also drastically cut down on the lead time to get the project up and running. “First oil on spec was September 2022,” said Ruggles recently in an interview with S&P Global Commodity Insights, noting that was just three months from June 13, 2021, when Oleo-X brought workers onsite. “For Unit 6, we can hit up to 3,000 b/d. And that’s the one we started commissioning back in September 2022,” Ruggles added. “Now we have units 2 and 7 which are commissioning. And that will get us up to 15,000 b/d. And by the end of the year after debottlenecking and other changes we believe that we will reach 30,000 b/d,” she said.

Challenges of renewable conversions

Many renewable projects, particularly those using existing refinery units like hydrocrackers converted to renewable use, have struggled with a learning curve in understanding how renewable feedstocks behave. This has led to more-frequent-than-anticipated catalyst changes for some plants. CVR Energy has had two catalyst changes at its renewable diesel unit at Wynnewood, Oklahoma, since the end of 2022. It added a PTU to the initial project which will start up in the third quarter of 2023, which CVR estimates will improve RD margins by about 30%. Vertex Energy, located in Mobile, Alabama, recently missed its announced start-up of its renewable diesel unit due to a problem with feed pumps which forced it to delay start-up. Vertex Energy has decided not to build its own PTU, but rather use an outside feedstock provider. “We are targeting facilities that need pretreatment or that are having issues…we are trying to have the feed that fits the catalyst,” Ruggles said. But regardless of what the feed is, Oleo-X’s comprehensive feedstock approval process means all raw feed material is rigorously tested before it is processed. “We do a lot of testing and we take the feed through our proprietary process and chemistry in order to take out and get near zero phosphorus and zero metals. And that is how you do not ruin (the) catalyst.” Ruggles said. Besides processing soybean oil and distillers corn oil (DCO) a byproduct of ethanol production, Oleo-X focuses on high acid feeds like poultry, which is readily available in the US. These second-generation feedstocks, including waste oils and animal fats are being used more and more for biofuel, according to a recent study by S&P Global Commodity Insights entitled, “Biofuel feedstock trade flows: First Come, First Served?”

Competitive advantage

Oleo-X recently brought on board as CEO Sergio Correa, a twelve year veteran of fuel trading and supply at Delta Air Lines and its Monroe Energy subsidiary which operates a refinery. “Our competitive advantage here as well is the locally sourced poultry low CI material," he said on the interview. “Renewable diesel plants come down and we believe that has a direct correlation to the feed that is being put in…we are determining what feedstocks we are going to run. Not only because of market conditions but really the unique plant configurations of each our customers are very different. So that is how we can tailor an approach that makes sense,” he said. Correa said that besides easy access to low CI feedstock and Oleo-X’s rigorous quality control technology, Pascagoula – located on the Gulf of Mexico – has access to two major US refined product pipelines feeding the US Atlantic Coast -- Kinder Morgan’s Southeast products pipeline and the Colonial Pipeline. “Our logistics are truly ideal. We have barge access, truck access, rail access. We have ability to participate in inland waterflows. And because we are on the water we have international feedstock flows which is something we will look to target,” he added.

Moving forward

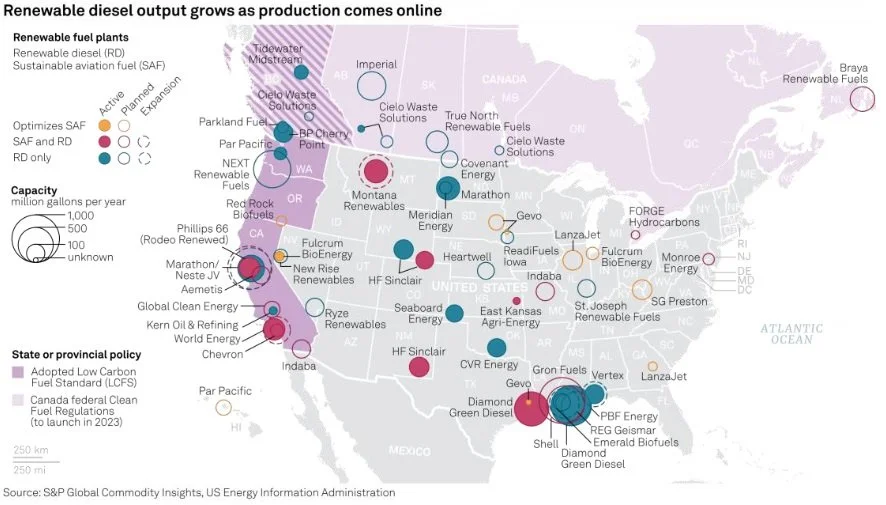

Besides increasing pretreatment plant throughput, Oleo-X has bigger ambitions in the renewable fuel arena as demand for renewable diesel grows. According to supply/demand estimates from S&P Commodity Insights, North American RD production is estimated to reach about 157,500 b/d in 2023 while consumption is forecast at about 174,000 b/d. By 2026, North American production is scheduled to grow to around 325,000 b/d while demand growth is forecast at about 327,000 b/d. Oleo-X is “running essentially three phases of growth,” according to Correa. Phase one is running the existing pretreatment unit continuously to get to 3,000 b/d. Phase two is starting and optimizing the larger pretreatment units up to 30,000 b/d. “And then the third phase is the engineering and design business development phase that we are also currently in to build our own renewable diesel and SAF capabilities here at the plant,” Correa said. Ruggles said that with hydrogen plants onsite at the Pascagoula facility, Oleo-X plans to build upon the pretreatment plant output, adding 15,000 b/d of RD and SAF production by building its own renewables fuel plant. Ruggles said the new RD and SAF plant would take about two years to complete, and embrace the company’s philosophy of reusing, repurposing and rethinking existing equipment to accelerate start-up and keep costs low. “That’s what we have been doing for 20 years,” Ruggles said.